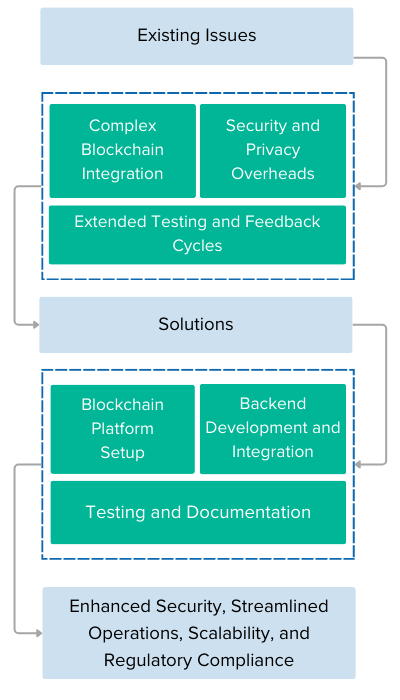

PROBLEM STATEMENT

Traditional KYC systems are plagued by inefficiencies, high costs, and

privacy concerns. The objective was to overcome these limitations by

integrating Distributed Ledger Technology (DLT) into KYC processes. The

project sought to build a secure and scalable framework capable of

handling sensitive customer data while complying with stringent

regulatory requirements. Key challenges included:

Complex Blockchain Integration: Aligning blockchain

components with traditional systems proved technically

demanding.

Security and Privacy Overheads: Ensuring data security

and compliance added significant costs.

Extended Testing and Feedback Cycles: Incorporating user

feedback required multiple iterations, impacting timelines and

budgets.

SOLUTION AND APPROACH

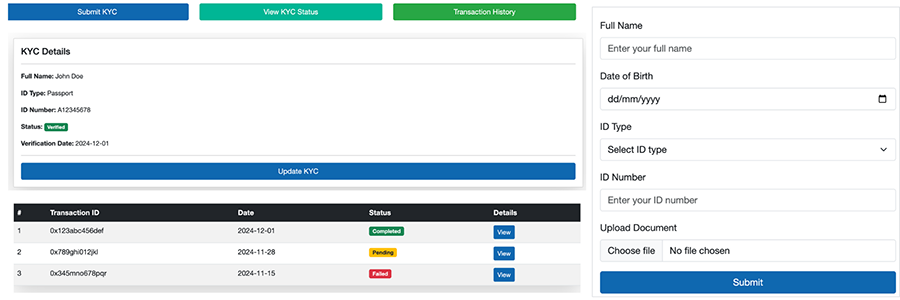

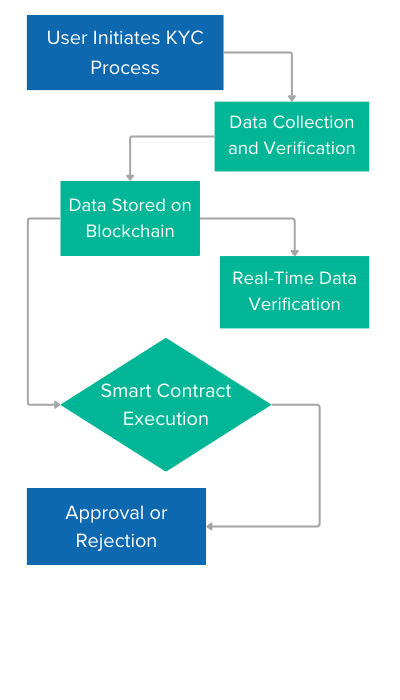

The team developed a functional KYC prototype using Batoi RAD,

Quorum blockchain, and smart contracts, focusing on

security, scalability, and compliance. The approach was structured into

three key phases:

Blockchain Platform Setup: Configured the Quorum

blockchain with secure nodes and network architecture. Developed

foundational smart contracts for automating KYC processes.

Backend Development and Integration: Integrated backend

systems using PHP and MariaDB. Connected the blockchain layer to

user interfaces for seamless interaction.

Testing and Documentation: Conducted rigorous security

and user acceptance testing (UAT). Created detailed technical

documentation for future scalability.

The project adhered to an iterative development methodology, ensuring the prototype met all user requirements through continuous feedback and improvements.

BENEFITS FOR CUSTOMER

Enhanced Security: By leveraging blockchain, the solution ensures

data integrity and protection against unauthorized access.

Streamlined Operations: Automated smart contracts reduce manual

intervention, speeding up the KYC process and lowering operational costs.

Scalability: The architecture supports future integrations with

banking systems, allowing the prototype to evolve into a comprehensive KYC

platform.

Regulatory Compliance: Advanced security features and robust

documentation make it easier for institutions to meet regulatory standards.