An early stage of digital money was the electronic exchange of cash between banks accounts or digital payments via credit/debit cards and is still in practice. Digital money facilitates fiat money (issued and supported by government authorities) such as US dollars, Canadian dollars, Euros, and more.

But, digital currency involves cryptocurrencies and other forms of currencies that were developed as a means of exchanges over the internet. After that, many governments generating fiat currencies also considered introducing their own digital currency as a variant of traditional money. For example, the Indian Government announced its own digital money in the January 2022 budget.

The article gently introduces the fundamental concepts of digital currencies, how they work, and ways to understand them better.

Digital Currency: An Overview

Any type of currency available in digital and electronic form is called digital currency. It is called digital money, electronic money, electronic currency, or cybercash.

Being available in electronic form only, digital currencies can be accessed from computers or mobiles connected with the internet or designated networks. With specific characteristics, digital currencies never demand intermediaries, enabling seamless, cheaper transactions for trading worldwide.

For example, if a person in the United States and a counterparty in Singapore are connected to the same network, they can make digital currency payments to each other. Never matter where individuals were born or where they live, digital currencies guarantee equal opportunity. They have the same crypto access as everyone else has provided if they have a smartphone or other internet-connected device.

Types of Digital Currencies

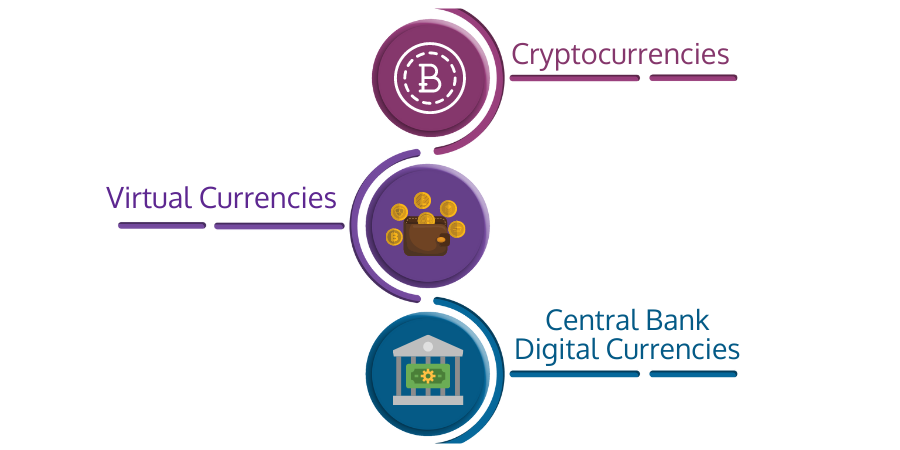

Digital currency encompasses different types of currencies available in the electronic domain.

Cryptocurrencies

Cryptocurrencies (Bitcoin and Ethereum, for example) are digital currencies that encrypt and validate network transactions using cryptography. The making of such currencies is managed and controlled using cryptography. Crypto uses blockchain technology, a digital ledger system, to record crypto transactions.Cryptocurrencies may or may not be regulated, depending on the regulated authority. And since they are unregulated and only exist in digital form, cryptocurrencies are classified as virtual currencies.

Virtual Currencies

Virtual currencies are unregulated digital currencies governed by developers or a founding organization. A set of network protocols can handle virtual currency algorithmically. A gaming network token is a virtual currency whose economic value is assigned and controlled by developers.Central Bank Digital Currencies

Central bank digital currencies (CBDCs) are regulated digital currencies issued by a country's central bank. They can be used as a supplement/substitute for standard fiat currency. Unlike fiat currency, which is available in both physical and digital forms, a CBDC is only available in digital form. Many counties, including the UK, are launching a digital version of their national currency.

Benefits of Digital Currency

- Speedy Payments: A user can complete payments considerably faster with digital currency than traditional methods like ACH or wire transfers which can take days for banking institutions to validate a transaction.

- Economical International Transactions: Users are charged significant costs to transfer funds globally, especially when currency conversions are involved. In addition, the employment of blockchain technology makes money transfers more secure, authorized, and cost-effective.

- 24x7 Access: Existing money transferring system takes a long time on weekends and outside of regular business hours since banks are closed and unable to verify transactions. Coupling transactions with digital currency can run at the same speed 24x7.

- More Efficient Government Payments: Instead of inspecting checks or figuring out debit cards, the government could build a CBDC and transfer payments like tax refunds, child assistance, and food stamps to people instantaneously.

Disadvantages of Digital Currency

Multiple Currencies to Navigate Simultaneously: Cryptocurrency's downside is its current popularity. There are a plethora of digital currencies being developed across several blockchains, and each has its own constraints. Therefore, determining which digital currencies fit specific use cases will take time, and inspecting which crypto is designed for large-scale adoption are both tricky.

Investing Efforts in Learning and Using Currencies: Digital currencies necessitate some effort for users to learn how to do essential functions - opening a digital wallet and securely storing digital assets. The system needs to be simplified for digital currencies to become more broadly acceptable.

Blockchain Transactions Might be Expensive: Cryptocurrencies deploy blockchain that demands computers to solve complex equations in order to validate and record transactions. This consumes a lot of electricity and becomes more expensive as the number of transactions increases.

Huge Fluctuation in Digital Currency Prices: The value and price of cryptocurrencies can fluctuate dramatically. Businesses are thinking twice about adopting it as a means of exchange. For instance, what if a business accepts something which is highly volatile? What happens if a user keeps a Bitcoin for a week and it loses 25% of its value? However, with CBDC value can be stabilized such as paper cash.

Future of Digital Currency

Digital currency is still in its infancy state. In recent years, cryptocurrencies have risen dramatically as many companies are using them to develop new services and products. Also, investors have accounted for cryptos in an investment asset category.For instance, if central banks generating and supporting fiat currency will issue their own digital currencies, they may shift the landscape.

In the current state of development, the future of digital currencies and digital assets using them is uncertain. Still, the continual advancement of technology predicts the spread of electronic money and payment systems well.

It is advisable to invest in this development through cryptocurrencies, stable coins, and corporate stocks engaged in their creation and use. It's a fascinating area to study for investors. If an individual invests in digital currency, he needs to stay diversified and focused in the long term.

Batoi Corporate Office

Batoi Corporate Office