Introduction

Distributed Ledger Technology (DLT) is a decentralized database managed by multiple participants across multiple nodes. In this case, the data isn't stored in a single location or controlled by a single entity. Instead, it's distributed across a network of computers (nodes) and managed by all participants in the network. This differs from traditional centralized databases, typically stored in a single location and operated by one organization.

It is the backbone of blockchain technology and is instrumental in the transition to the next generation of the internet, known as Web 3.0. In this article, we will delve into the specifics of DLT, its role in shaping Web 3.0, and a use case of DLT’s potential impact on KYC procedures.

Understanding Distributed Ledger Technology

At its core, DLT is a consensus of replicated, shared and synchronized digital data spread across multiple sites, countries, or institutions. Unlike traditional databases, there's no central administrator or centralized data storage in DLT. This decentralization is a critical factor, as it makes DLT highly resilient to cyber-attacks, fraud, or any single point of failure.

In a DLT, each participant (node) in the network maintains a copy of the entire database. Any changes or additions to the database, such as new transactions, must be verified by a consensus mechanism, where a majority of participants in the network agree on the validity of the transaction. Once validated, the transaction is added to the ledger, and the change is reflected across all copies of the database. This makes the ledger transparent, as all participants can see the same transaction history, and secure, as no single participant can alter past transactions.

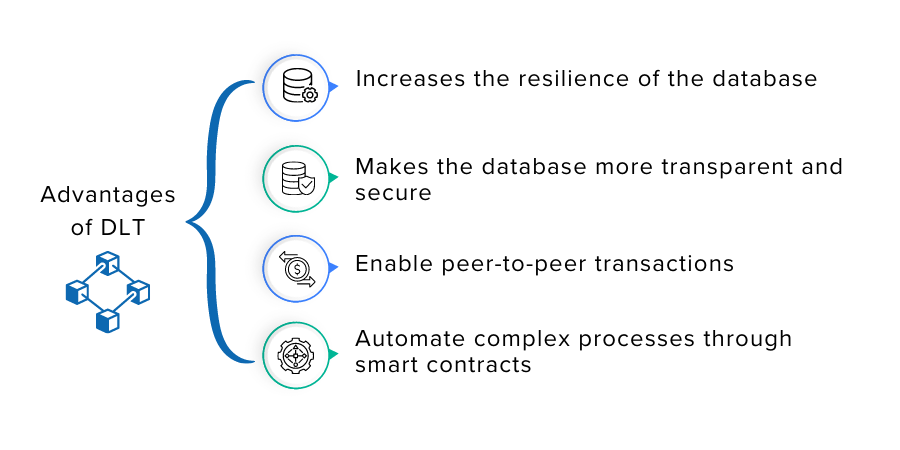

The decentralization of DLT has several advantages. It increases the resilience of the database, as there is no single point of failure. It also makes the database more transparent and secure, as all transactions are publicly verifiable and cannot be altered once they've been added to the ledger. Furthermore, by removing the need for a central authority, DLT can enable peer-to-peer transactions and automate complex processes through smart contracts.

DLT's most famous application is blockchain, a type of distributed ledger where data is stored in blocks, and each block is linked to the previous one, forming a chain. This design, combined with cryptographic techniques, ensures that once data is added to the blockchain, it is virtually impossible to alter or delete.

DLT's Role in Web 3.0

Web 3.0, often referred to as the decentralized or semantic web, aims to create a version of the internet that is powered by artificial intelligence and semantic web technologies. In Web 3.0, machines will be able to read and understand the information as humans do, leading to more interactive and tailored user experiences.

DLT is fundamental to Web 3.0 as it provides a framework to create a decentralized web with no central authority. For instance, DLT can enable decentralized social networks, financial systems, supply chains, and more, where users have control over their own data.

DLT and blockchain also provide the foundation for smart contracts – self-executing contracts with the terms of the agreement directly written into code. Smart contracts can automate complex processes, enabling a new level of interactivity and intelligence on the web.

DLT and KYC: A Use Case

Know Your Customer (KYC) is a process used by businesses, particularly in the financial sector, to verify the identity of their clients. This process is a critical component of anti-money laundering (AML) policies and is used to prevent identity theft, financial fraud, and terrorist financing. During the KYC process, businesses collect and analyze pertinent details about a customer's identity and potential risks associated with that customer. This may include collecting official identification documents, proof of address, and in some cases, information about their financial activities. Compliance with KYC regulations is mandatory in many jurisdictions, with severe penalties for non-compliance. The goal of KYC is to ensure that businesses are doing their due diligence to prevent illicit activities and to ensure that they know who they are doing business with.

Without DLT, the financial industry has to rely on traditional, centralized systems for KYC checks. These systems are often slow, inefficient, and costly. Each institution has to collect and verify the same information, leading to duplication of effort and a higher chance of errors.

Furthermore, without DLT, the industry lacks a shared, reliable source of truth for KYC data. This can lead to inconsistencies in information and difficulties in tracing back changes or verifying the accuracy of data.

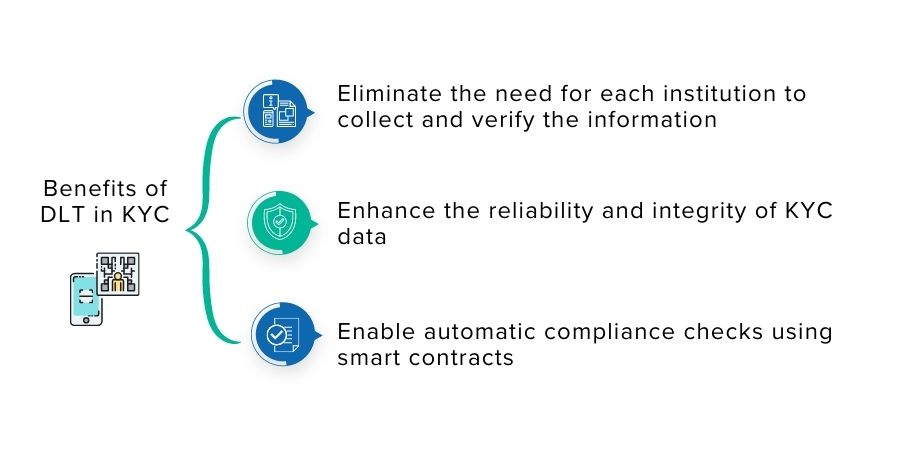

DLT can revolutionize KYC checks. By creating a shared, immutable ledger of KYC data, DLT can eliminate the need for each institution to collect and verify the information. This can reduce the time and cost of KYC checks. In a traditional setup, let's consider John, a customer who wants to open accounts with Banks A, B, and C. In the current system, John would have to provide his identification documents and other necessary details to each bank separately. Each bank would then verify this information independently, leading to duplication of effort and increased cost. With DLT, once John's KYC is completed by Bank A and the data is stored on the blockchain, Banks B and C can access this already verified information without having to redo the entire process. The shared ledger eliminates redundant work, reducing time and cost.

Second, DLT can enhance the reliability and integrity of KYC data. With DLT, each change to a customer's KYC data is recorded on a tamper-proof ledger, making it easy to audit and trace back any changes. Continuing with the same example, if John changes his address, this information is updated on the blockchain. Every change is recorded as a new transaction on the ledger, providing an audit trail. Suppose John's new address was initially entered incorrectly by Bank A, and later corrected by Bank B. The blockchain will reflect both these changes, making it easy to trace back any discrepancies or errors. This audit trail makes the data more reliable and ensures the integrity of the information.

Third, DLT can enable automatic compliance checks using smart contracts. A smart contract is a self-executing contract where the terms and conditions are written in code. For KYC, a smart contract could be designed to check that a customer's information meets all regulatory requirements. For instance, if a regulation requires that all customers must be above 18, the smart contract could automatically check the customer's date of birth and flag any customers who are underage. This automated compliance check reduces the burden of manual checks and minimizes the risk of non-compliance.

The power of DLT lies in its ability to create a secure, shared, and transparent source of truth, which can streamline processes like KYC checks that traditionally rely on manual, siloed systems.

Conclusion

DLT is a transformative technology that is shaping the future of the web and can potentially revolutionize industries like finance. By providing a decentralized, immutable, and transparent way of recording and verifying information, DLT can make processes like KYC checks more efficient, reliable, and secure.

Further Reading

Here are some online resources that you can refer to for further reading:

Distributed Ledger Technology: What Is It and Why Do We Care? - A beginner-friendly article by Better Than Cash Alliance explaining DLT.

Blockchain Technology Explained - An article by Investopedia explaining blockchain, a type of DLT.

Smart Contracts - An article by Investopedia explaining the concept of smart contracts.

Welcoming Web 3.0: The Critical Role of Blockchain in Web 3.0 Development - An article by IEEE Computer Society

Batoi Corporate Office

Batoi Corporate Office