We live in a world in which we are surrounded by many industries, including the banking sector. All these industries generate vast amounts of data daily, which needs to be regulated. Simple tools can’t manage this, so a technology called “Big Data” comes. Data sets of structured and unstructured formats, which all belong to the same context, are known as "Big Data." The major companies, including Amazon, Apple, Facebook, and Microsoft, have enormous databases that give them a competitive edge. Such data sets from multiple sources go beyond what we typically expect from our information processing tools. Therefore, keeping a close eye on how these businesses use the Big Data tool is important.

Why is the need for Big Data is Increasing Day by Day?

Big data is an expanding collection of information with different types and patterns. Its principal sources could include:

- The online world, i.e., social media

- Information gathered by user devices through computers and mobile phones

- Corporate resources (archives, databases, etc.)

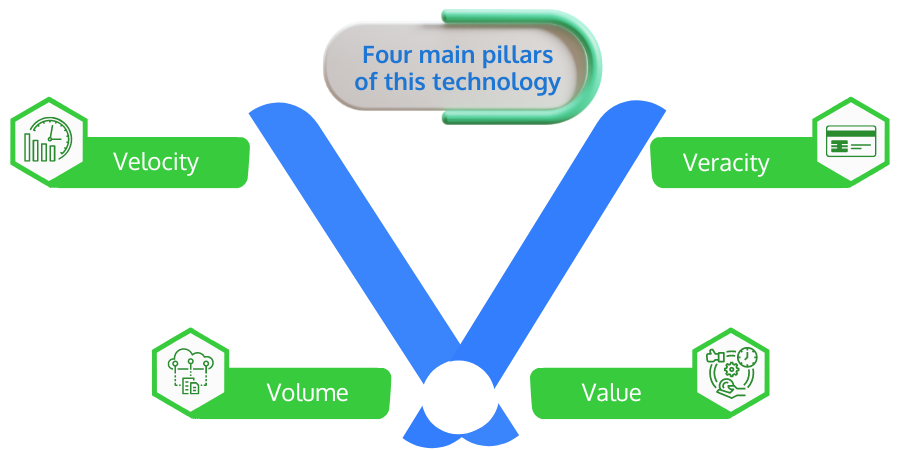

Because it is equipped to handle such a range of data sources compared to a traditional computer, it is becoming a need of an hour. The four main pillars of this technology are velocity, volume, value, and veracity. Let's have a close look at it:

- Velocity - This represents the frequency of updating the database with fresh information.

- Volume - This represents the amount of room the data will need in storage.

- Value - Utilizing the outcomes of big data analysis to make business choices in real time.

- Veracity - As the bank generates a vast amount of data daily, from transaction details to the monthly credit card summary, this pillar represents processing different kinds of data.

How is the Banking Sector Using Big Data?

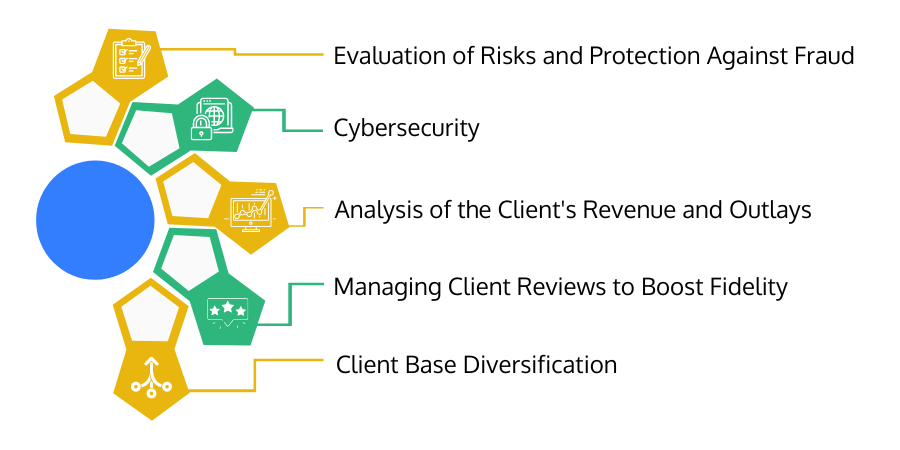

In today’s digital world, big data is used in the financial industry to ensure cyber security and increase customer loyalty. Now that big data is available; banks can better structure their revenue and expenses, comprehend their transaction channels, gather feedback based on consumer reviews, and even avoid fraud. Let's have a brief about these:

1. Analysis of the Client's Revenue and Outlays

A variety of information about the earnings and expenses of customers is available to banks. This finding corresponds to the income that entered their accounts during that period and their wages for that period.

A commercial bank can use this data to assess the client's earnings and determine whether it has risen or significantly reduced, which revenue sources have been more reliable, how much money was spent, and which routes the client utilized to conduct various transactions. By analyzing the data, banks may analyze the risks, decide whether to extend loans, and determine if the client is keener on receiving advantages or buying assets.

2. Client Base Diversification

The bank divides its clients into various categories based on many factors after examining the revenue structure. And as a result, the staff of the banking institution will be better able to market additional goods and draw clients in by using customized offers.

Additionally, the bank can make precise plans to guarantee the net profit and optimize revenue by estimating the clients' anticipated earnings and expenses for the upcoming month.

3. Evaluation of Risks and Protection Against Fraud

The bank can detect problems more quickly when it knows people's typical financial activity patterns. As an illustration, if a "precautious investor" attempts to extract the entire balance from their account, this may indicate that the card has been hacked and used by scammers. The bank will contact the client to understand what's happening in this circumstance. It considerably lowers the chance of fraud in analyzing different forms of transactions.4. Managing Client Reviews to Boost Fidelity

In the modern world, customers can submit comments on a banking institution's performance by call, online, or social media. With the aid of this, experts examine these currently accessible mentions. As a result, the bank can respond to feedback promptly and appropriately. Customers become more devoted to the brand as a result of this.

5. Cybersecurity

Indeed, the strongest corporations in the world have to deal with embezzlement because it is an issue they even encounter. Cyber threats and online bank crimes are both persistent. Many big businesses, especially banks, have fallen prey to cyber-attacks where not only wealth but also client data was taken. Because a member of the organization may occasionally carry out these tasks, banks can set up effective internal surveillance systems using big data and artificial intelligence tools. They can also use advanced analytics to analyze consumer behavior. Furthermore, they can actively engage and share the knowledge gathered from their business analytics and big data analytics tools with government entities to reduce risks in the scenario of financial crime.

Big Data analysis nowadays opens up fresh opportunities for business expansion. Financial firms like banks that use this technology have a better understanding of consumer needs and produce reliable results. As a result, they can react to market needs more quickly and effectively.

Batoi Corporate Office

Batoi Corporate Office